The Hidden ROI of Technical Due Diligence in Software Investments

- Chris Woodruff

- September 29, 2025

- Business of Software

- business of software

- 0 Comments

If you're looking to enhance your organization's ROI through strategic software investments, I would love to connect with you. Let's explore how I can contribute to your success. You can easily reach me via my contact page here: https://woodruff.dev/contact/

Most investment decisions focus on financials, not software foundations

When investors assess a company, the starting point is often its financial performance. Key indicators like revenue growth, profitability, and market share are crucial in shaping their investment decisions. However, for technology-driven businesses, the real determinant of value is the robustness of the software that underpins their operations, delivers services, and scales to meet demand.

Neglecting the state of the software can transform a seemingly promising investment into a disappointing one. While solid financials may suggest stability, weak software can swiftly erode that impression. This is precisely why conducting thorough technical due diligence is non-negotiable for securing investments.

Hidden technical debt can erode valuations and stall growth

Technical debt is often one of the most underestimated risks in technology investments. This debt builds up when teams make short-term trade-offs in design or development. Factors like poor documentation, rushed architectural decisions, and inadequate testing all contribute to its accumulation. At a small scale, these issues may go unnoticed, but they become apparent as growth accelerates.

Hidden technical debt can significantly reduce a company’s valuation and hinder its expansion. A company may promise rapid product delivery but struggle to execute because its systems lack the resilience needed to support new features. Another company might report impressive early adoption numbers but collapse under heavier loads. This risk is very real; investors who acquire companies without thoroughly investigating their technical health often find that growth projections were overly optimistic due to the inability of the underlying systems to sustain them.

Technical due diligence uncovers risks early

The solution is simple: conduct technical due diligence with the same level of rigor as financial or legal reviews. Technical due diligence uncovers flaws that financial metrics may overlook. It clarifies whether a company’s software assets can genuinely support the presented business case.

By assessing the state of the codebase, architecture, security posture, and licensing compliance, investors gain insights into the long-term viability of their targets. This process not only identifies potential issues but also establishes a baseline for determining the necessary investment to align technology with business objectives.

What technical due diligence includes

Codebase quality

Software lives and dies by the quality of its code. A review of the codebase assesses its readability, maintainability, and testing. Code that is unnecessarily complex slows down development cycles and multiplies the chance of defects. Clean, consistent code enables new developers to contribute quickly and supports faster release cycles.

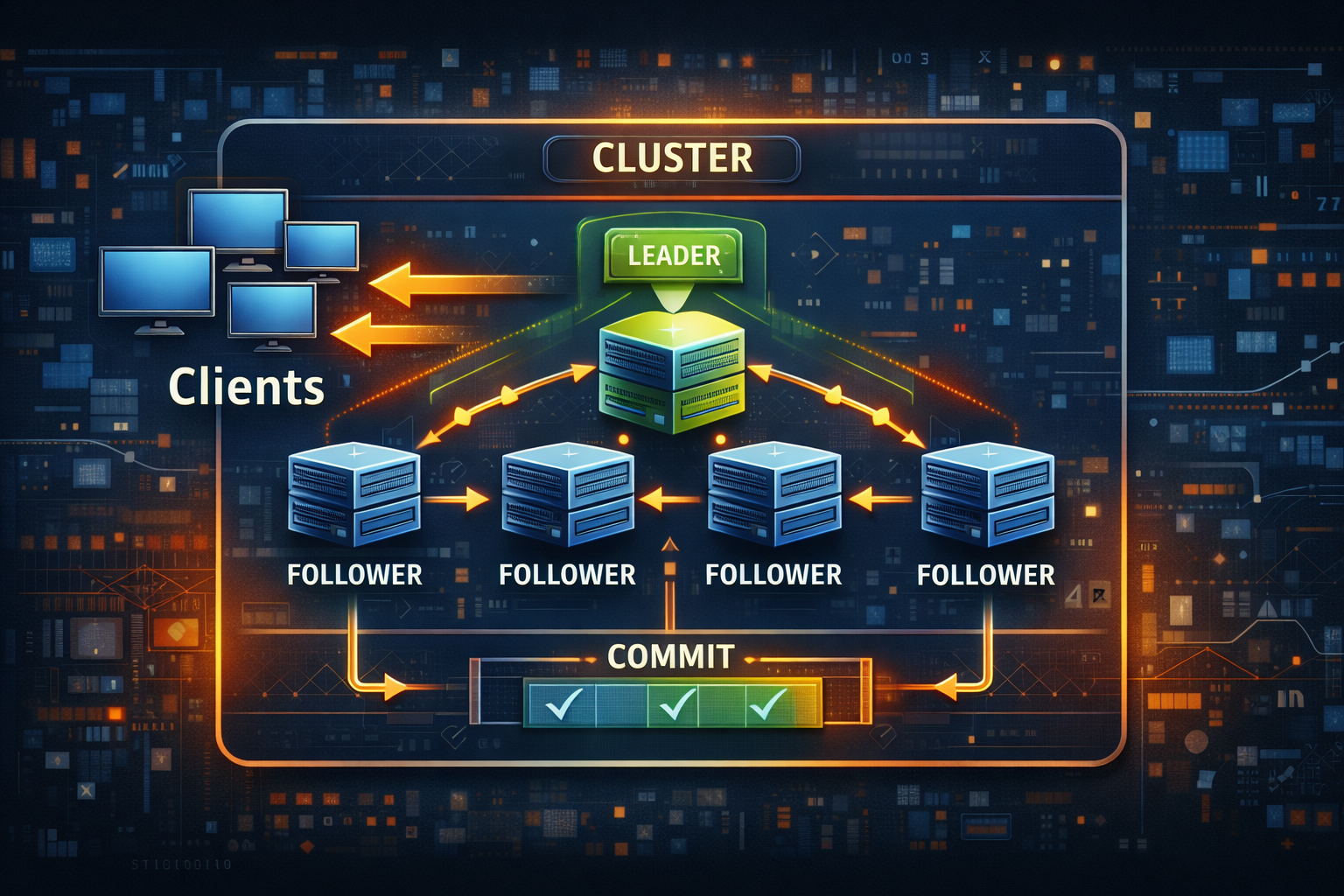

Architecture scalability

The ability to scale is central to a company’s growth. An assessment of architecture reveals if the system can handle increased traffic, adapt to new markets, and incorporate emerging technologies. Architecture that cannot scale will eventually choke growth and require costly rework. Scalability is not a nice-to-have feature; it is essential to long-term success.

Security posture

Security failures carry both financial and reputational costs. A thorough review of security practices examines how applications protect data, manage access, and withstand attacks. With regulations tightening and customers becoming increasingly concerned about privacy, weak security can erode trust and lead to penalties.

Licensing compliance

Open-source components form the backbone of most modern applications. If these components are not properly licensed, a company can face legal disputes that jeopardize intellectual property. Technical due diligence reviews licensing records and dependencies to ensure that the assets being acquired are truly owned and free of encumbrances.

Benefits of technical due diligence

The value of technical due diligence extends beyond risk avoidance. It creates positive returns in multiple areas.

Avoiding costly rework

When issues are discovered before acquisition, buyers can negotiate solutions or walk away. If overlooked, those same issues often demand millions in remediation. Early detection prevents the hidden drain of expensive rewrites and redesigns.

Faster scaling post-acquisition

If systems have been vetted for scalability and code quality, integration into a larger enterprise happens faster. Teams can focus on innovation rather than patching foundational issues. This accelerates time-to-market for new offerings and helps realize growth projections more reliably.

Stronger negotiating position for both sides

Clear insight into technical strengths and weaknesses empowers buyers to set fair valuations. Sellers with strong technical hygiene can demonstrate their value with evidence, often commanding higher multiples. The process promotes transparency and confidence, benefiting both parties.

Technical due diligence is not a cost; it is insurance and acceleration

Investors often underestimate technical due diligence, viewing it as an unnecessary expense. In reality, it is essential—acting as both a form of insurance and a powerful growth accelerator. It actively protects capital from hidden risks and ensures that technology assets are fully capable of supporting expansion.

Financial reviews may suggest potential, but only technical reviews can definitively confirm that this potential will be realized. The hidden return on investment (ROI) of technical due diligence is significant, as it transforms uncertainty into unwavering confidence. This positions both investors and companies to aggressively pursue growth without the burden of unseen obstacles.